In May, earnings reports for several of the stocks I own will be available for scrutinising and I'll look for any forward guidance but with the US tariffs and unpredictability, I don't expect much in the way of guidance except for those not directly affected by the tariffs.

Canada's newly elected Prime Minister will be in office in May and see what comes of trade talks with the US.

With politics weighing more than usual on the North American stock markets, I look at the economy as well and what's happening internationally in relation to us here in Canada.

China, one of the largest oil importers in the world is shifting from the US and buying more oil from Canada. A bright spot in the crazy international tariff war going on.

I own several oil, natural gas and pipeline related stocks based in western Canada. I'm sure they welcome the increased export to China and other Asian countries as natural gas shipments will ramp up as well with projects like the LNG Canada, Kitimat Natural Gas Facility in BC coming online in mid 2025.

Enbridge, ENB.TO comes to mind with their pipelines and oil/natural gas storage/shipping faculties. Companies like Canadian Natural Resources, CNQ.TO, Suncor, SU.TO and Tourmaline Oil, TOU.TO.

Enbridge and Fortis, FTS.TO are companies I'll be looking at in mid May for further buying. FortisBC and Enbridge have a partnership with Natural Gas storage and shipping in BC.

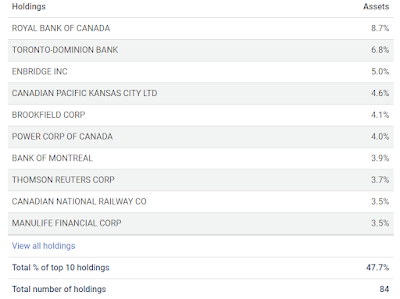

I bought into Royal Bank's RCDC, RBC Canadian Dividend Covered Call ETF soon after it launched in January of 2023 and although the MER of 0.71% is high, I hold it for the cash distributions and not for growth although it had a return of 16.9% in 2024 so can't complain.

This year it dipped with the US tariff barrage on Canada but has come back up to the $20 CAD range with a current yield of 7.39%.

I like the top ten holdings by weight with Royal Bank, TD Bank and Enbridge at the top with a mix of sectors included.

The ex-dividend date for RCDC is April 23rd and I plan on further buying into that ETF. I look at as an affordable option than buying some of the big banks of Canada although I hold them all with the exception of National Bank with plans to buy that stock this year.